7. Information For Each Transaction Recorded In A Journal

When a law receives an amount of cash on behalf of a correspondent the transaction will. Journalizing transactions transfers information from accounting equation analysis to a record of each transaction.

Journal Entry Example Top 4 Examples Of Journal Entries In Accounting Learn Accounting Accounting Principles Accounting Student

A journal amount column headed.

7. information for each transaction recorded in a journal. Each journal entry is also accompanied by the transaction date title and description of the event. 166 Chapter 7 Posting Journal Entries to General Ledger Accounts. Transactions are recorded chronologically.

Which of the following describes how the transaction should be recorded on July 7. A journal entry includes A the debit part of a transaction recorded under one date and credit part recorded under a later date. Chronological Record Transactions are recorded in a journal by.

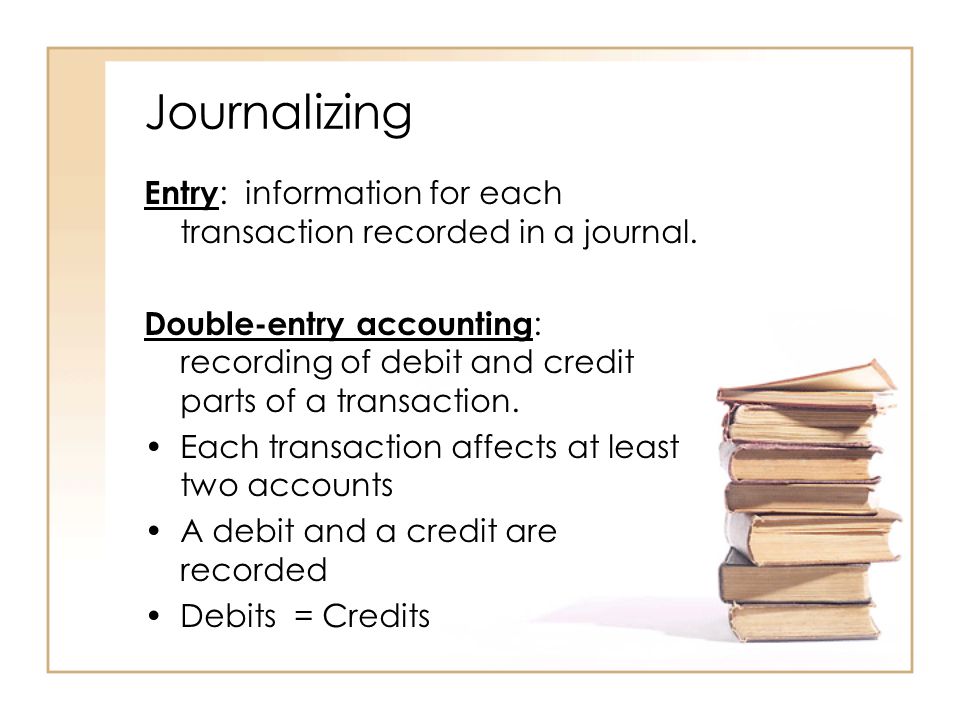

A business paper from which information is obtained for a journal entry. Information for each transaction recorded in a journal General Journal. The recording of debit and credit parts of a transaction.

There are debit and credit columns storing the financial figures for each transaction and a balance column that keeps a running total of the balance in the account after every transaction. The date of each transaction related to this account is included a possible description of the transaction and a reference number if available. The information can be verified by comparing the data in the journal with the transaction data to assure that all infor-mation is correct.

The journals list the information for each transaction. A journal with two amount columns in which all kinds of entries can be recorded. An entry consists of four parts.

B the debit and credit parts of a transaction recorded in one place. Double-Entry Accounting The recording of debit and credit parts of a transaction. A business form ordering a bank to pay.

A journal with two amount columns in which all kinds of entries can be recorded Double-Entry Accounting. 19 rows What information for each transaction recorded in a journal is called. A business paper from which information is obtained for a journal entry Check.

So journal is also called a day book. Sold inventory on account. Since there are so many different types of business transactions accountants usually categorize them and record them in separate journal to help keep track of business events.

D none of these. C more debits than credits. Transferring the debit and credit information from the journal to individual accounts in the general ledger.

On the date each transaction is posted in the sales journal the appropriate information would be posted in the subsidiary ledger for each of the customers. Journal is the first successful step of the double entry system. For each transaction recorded in an accounting system.

A business paper form which information is obtained for a journal entry. The Objective Evidence accounting concept requires that there be proof that a transaction did occur. A journal with two amount columns in which all kinds of entries can be recorded invoice a form describing the goods or services sold the quantity and the price.

The recording of debit and credit parts of a transaction Source document. Information recorded in a journal includes the debit and credit parts of each transaction recorded in one place. A transaction is entered in a journal before it is entered in ledger accounts.

Because each transaction is initially recorded in a journal rather than directly in the ledger a journal is called a book of original entry. Here is an example of how the vehicle purchase would be recorded. Start studying Journalizing Transactions.

1 date 2 debit 3 credit and 4 source document. A form for recording transactions in chronological order. The receipt of cash from the sale of goods as payment on accounts receivable or from other transactions is recorded in a cash receipts journal Figure 712 with a debit to cash and a credit to the source of the cash whether that is from sales revenue payment on an.

To learn the current balance of important accounts like Accounts Receivable and Accounts Payable managers look at the general ledger. As an example on January 3 amounts related to invoices 45321 and 45322 are posted to Bakers and Alphas accounts respectively in the appropriate subsidiary ledger. There are several formatting rules for journalizing transactions that include where to put debits and credits which account titles come first the need for a date and inclusion of a brief description.

Learn vocabulary terms and more with flashcards games and other study tools. The ledger may be in. A business form ordering a.

A transaction is recorded first of all in the journal. For each transaction indicate whether it would normally be recorded in a cash receipts journal cash payments journal sales journal single-column purchases journal or general journal. Managers use ledgers to obtain summarized information.

Information in a journal includes the debit and credit parts of each transaction recorded in one place. Before a transaction is recorded in a journal the transaction is analyzed into its debit and credit parts. By posting the information to the ledger accounts the cumulative information for each type of transaction is recorded in a single account.

Received but did not pay phone bill. Obtaining information about external transactions from source documents. LO 72 For each of the transactions state which special journal sales journal cash receipts journal cash disbursements journal purchases journal or general journal and which subsidiary ledger Accounts Receivable Accounts Payable or neither would be used in recording the transaction.

Reset Selection Question 22 of 35. So journal is called the book of original entry. A journal includes the debit and credit parts of each transaction recorded in one place.

Find information about a specific business transaction a manager can refer to the journal entry. Information for each transaction recorded in a journal. Information for each transaction recorded in a journal.

Information for each transaction recorded in a journal is known as an entry. A transaction is recorded on the same day it takes place. A ledger general ledger is the complete collection of all the accounts and transactions of a company.

Learn The Basic Accounting Collection And Recording Terminology Accounting Cycle Accounting Education Learn Accounting

Notary Public Journal Notary Public Notary Recorded Books

Pin By Jaimie Mcgrath On Career Stuff Journal Entries Accounting Journal

Basic General Journal Entries And Format Journal Entries Bookkeeping Business Accounting Basics

Journals Source Documents Recording Entries In A Journal Ppt Video Online Download

What Is Accounting Ledger Explained With Examples Accounting Learn Accounting General Ledger

How To Learn Accounting On Your Own Learn Accounting Accounting Business Books

General Journal Entry Template Double Entry Journal Journal Entries Journal Template

Five Bookkeeping Tips For Business Owners Small Business Bookkeeping Accounting Bookkeeping And Accounting

Completing Accounting Cycle In 5 Steps Reporting And Auditing Accounting Cycle Accounting Accounting Student

Trial Balance Journal Entries Excel Dashboard Trial Balance Journal Entries Trials

Century 21 Accounting C 2009 South Western Cengage Learning Lesson 8 1 Recording Adjusting Entries Accounting Pe Lesson Plan Examples Lesson Accounting Period

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Accounting Basics Accounting Principles Learn Accounting

Posting In Accounting Double Entry Bookkeeping Accounting Accounting Basics Accounting Education

Posting Komentar untuk "7. Information For Each Transaction Recorded In A Journal"